Business e-accounts

Make your business transactions easier, quicker and better

Unique IBAN per account and per currency, with 24/7 access to funds.

Easy currency conversions at market exchange rates (including EUR, USD, GBP, AED, CHF, PLN, SEK, ILS, DKK, AUD, ZAR, CAD).

Local and cross-border incoming and outgoing payments in the fastest way possible, thanks to our membership of both SEPA and SWIFT.

Instant payments within the UK through CHAPS, BACS and Faster Payments.

Valuable support provided by your dedicated account manager to help you address any issues you are facing in your payment processes.

Key features

Opening an e-account just got easier via our in-house onboarding module with dedicated dashboard, live status update, notifications and KYC uploading. The customer onboarding module allows any existing or potential customers to log in from their internet browser and/or mobile phone and initially register as a user.

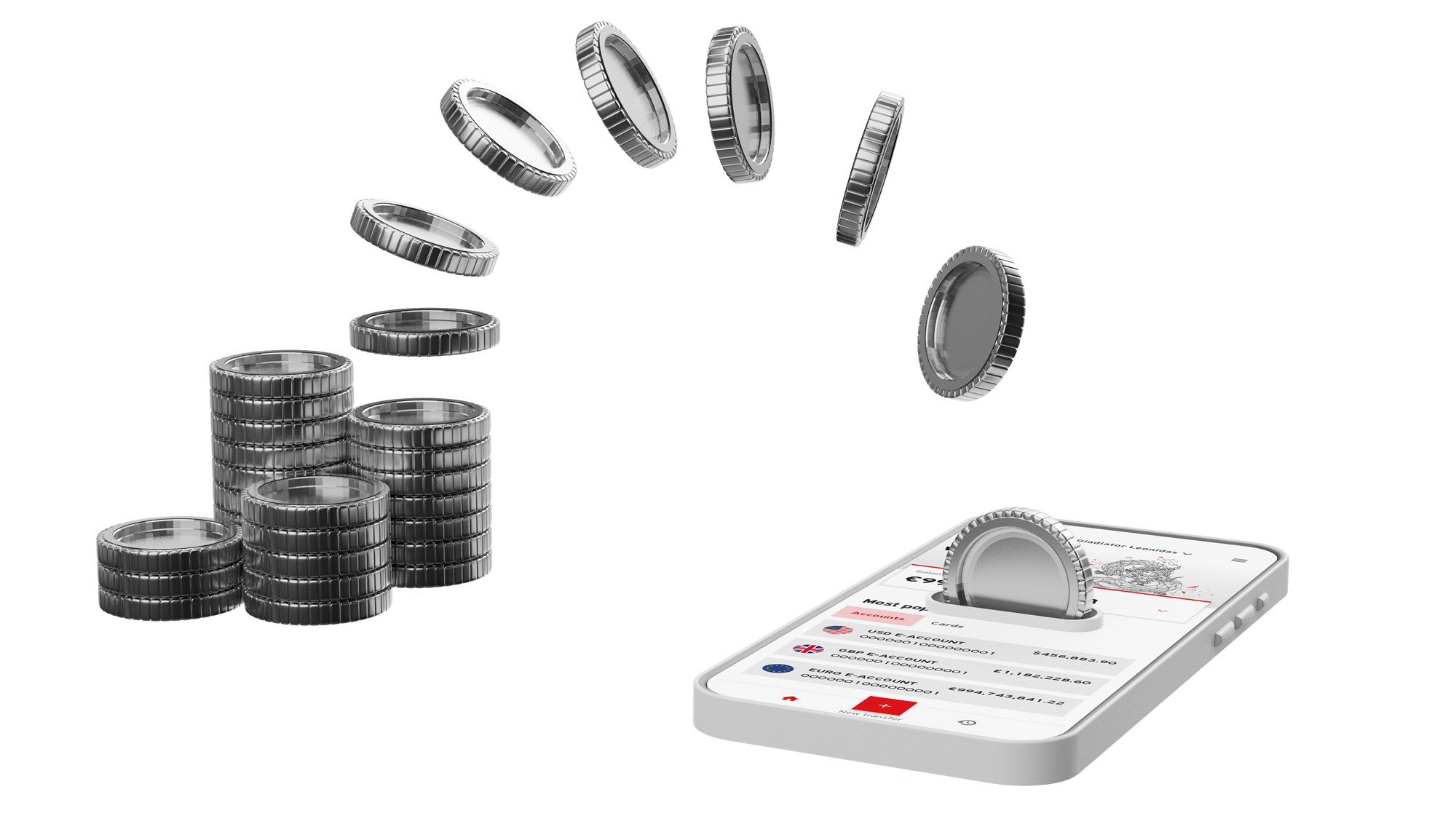

Multi-currency conversions

With ECOMMBX, and thanks to our global partnerships, you can rest assured that your multi-currency payments and money management in general will benefit from better rates for cross-currency transfers.

Furthermore, to make sure you have a clear overview of all your payments and accounts, we’ve adopted the latest fintech with interactive screens that allow you to consolidate your transactional flow and generate all the reports and statements you need – in an instant.

At ECOMMBX we’ve integrated our own personal dealer room to help facilitate your foreign exchange transfers. With access granted directly through your Internet Banking channels, our ECOMMVERSE. You can execute transfers with real-time (competitive) rates, at a click of a button.

EUR

USD

GBP

INR

AED

CHF

AUD

SEK

ILS

ZAR

HKD

NZD

CAD

DKK

PLN

RON

SGD

JPY

Unique virtual IBAN

ECOMMBX can issue unique virtual IBANs in the name of your company in four different currencies: GB, DK, DE, LU

*Upon availability

This gives your business a powerful competitive edge by unlocking access to new markets and currencies in various jurisdictions. To pre-empt your questions, account setup is quick, pricing for accounts and transactions is competitive, and reconciliation of accounts is instant and accurate. What’s more, the clear segregation of funds and full transparency reduces AML and KYC risk.

Banking made faster, easier and safer

Online banking has revolutionized the way both local and international business works these days. In fact, the more efficient, user-friendly and market-oriented your online banking platform is, the greater the chances of your business being successful and profitable by saving valuable work hours and minimizing the risks of mistakes and fraud.

For your own company accounts as well as linked accounts for your staff, clients, or associates, e-accounts for all can be held under the ECOMMBX umbrella in the currencies of your choice.

Our payroll templates are all set for you to simply enter the details of all your employees: name, surname, iban, salary, etc. Keep your list up-to-date, and your salary payments will be a matter of a few clicks… done. It’s the quick, accurate and efficient solution for today’s successful and reputable organizations.

For mass payments, we also provide a set of different templates that match various types of mass payment, depending on the nature of your business. With SEPA already available and SWIFT being incorporated soon, our mass payment solutions will significantly boost the performance and efficiency of a company’s accounts department by allowing you to execute multiple transfers all simultaneously.

In cases where an escrow account will facilitate the way you operate and provide assurance to both parties involved in your business transactions, we can offer you this service to complement your business e-accounts.

Payments via our clearing houses

Thanks to our access to 35 local clearing schemes around the world – either directly or via our partner banks – ECOMMBX facilitates cross-border payments in over 20 currencies, efficiently and cost-effectively. If in doubt, give us a call to discuss your individual needs, so we can identify the ideal route for any cross-border, cross-currency payments.